Sales tax compliance for multichannel retail

Aggregate multichannel sales data through a single solution that automates filings and remittances

Aggregate multichannel sales data through a single solution that automates filings and remittances

Whether you’re selling apparel, outdoor furniture, or school supplies, a miscategorized product can create compliance issues. And keeping up with changing tax laws and rates across all states takes precious time and resources away from your business. TaxJar’s close monitoring of tax laws and rates, along with our robust product tax content, ensures you charge the correct rates no matter where you sell.

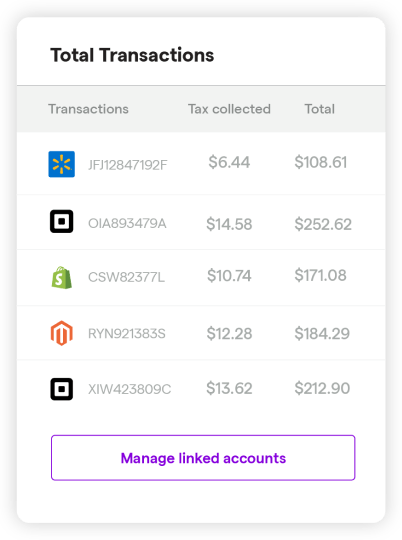

We make it easy for you to connect your sales channels and systems to TaxJar. Connect with one or many of our vetted e-commerce and ERP platforms, marketplaces, and shopping carts directly from your TaxJar dashboard. If your needs go beyond our pre-built solutions, you can customize your integration with the help of our technical team.

Multichannel online retailers are expected to generate over $575 billion in sales by 2023.

Meeting customer demand across all channels you sell through is no longer a nice-to-have. It’s expected. Maintaining an integrated customer experience during your busiest seasons such as Black Friday or Cyber Monday is challenging, especially as you sell into more states. With TaxJar’s lightning-fast, reliable API and sales tax engine, you’ll never need to worry about inaccurate rates, delays at checkout, or missing economic nexus obligations.

TaxJar simplifies sales tax compliance every step of the way. Here’s how our platform works:

Prebuilt integrations with popular platforms quickly connect TaxJar to your existing systems.

Our Nexus Insights Dashboard and notifications help you stay ahead of your sales tax responsibilities by state.

Our real-time calculation engine and sales tax API provides rooftop-level, product-specific sales tax.

Our reporting dashboard compiles data from all your channels to give you the most up-to-date view of your transactions and tax liability.

TaxJar AutoFile prepares and submits an accurate return and remittance for each state in which you’re enrolled.