Amazon Fulfillment Center: San Bernardino, California

by November 1, 2020

The Amazon Fulfillment Center in San Bernardino is one of six fulfillment centers in California with the others located in Patterson, Stockton, Tracy, Moreno Valley, and Redlands.

Amazon Fulfillment Center San Bernardino, California Facts

Warehouse Number: ONT2

Address: 1910 E Central Ave. San Bernadino, CA, 92408

Size: 1 million square feet

What does the San Bernardino, California Amazon Fulfillment Center mean for Amazon FBA sellers?

So most states are either an origin-based or destination-based sales tax state, however, California is a hybrid of the two. This can make things confusing for an FBA seller, however, we think we can simplify it. Basically, if you utilize the fulfillment center in San Bernardino, California considers you to have nexus in the state, which means you have to charge the California sales tax rate to everyone outside of the San Bernardino district. For customers who live within the San Bernardino district, you would charge them the state rate and the district rate.

For example, you sell a teddy bear to a customer in San Francisco, to that customer you would charge the state sales tax rate. Then let’s say you sell a teddy bear to a customer in San Bernardino, you would charge that customer the state rate AND the district rate.

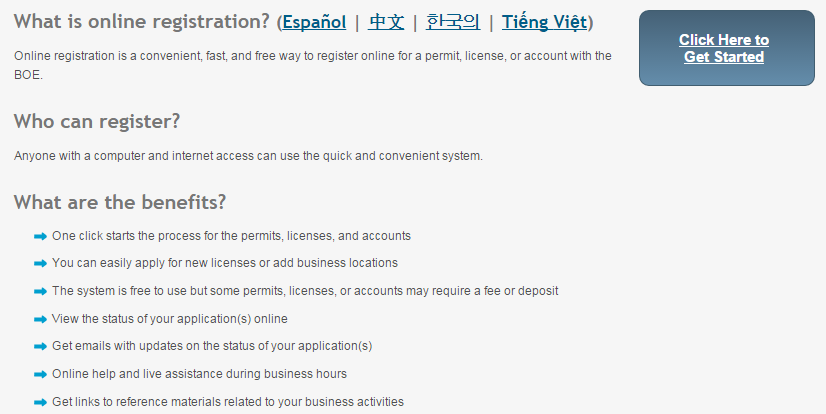

If you have nexus in the state of California, be sure to register your business. You can do so at the California Board of Equalization’s Online Portal.

So what does this mean for FBA sellers?

- If you find that you have sales tax nexus in California, be sure to register for a sales tax permit.

- Check out how to properly collect and remit sales tax in California.

- If you need more help, check out our FBA Sales Tax Guide

To learn more about Amazon’s San Bernardino, California Center:

A look at Amazon’s San Bernardino Fulfillment Center on Cyber Monday – The SB Sun