Is Shipping Taxable in North Carolina?

by August 13, 2015

Last updated July 14, 2017

The trouble with sales tax is that every state is different. Some states want you to charge sales tax when you charge your customer for shipping, others don’t. Today we’ll look at shipping taxability in the state of North Carolina.

Is Shipping Taxable in North Carolina?

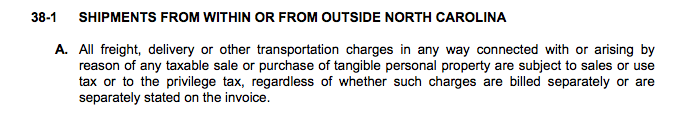

Here’s what the North Carolina Department of Revenue has to say in Sales and Use Tax Technical Bulletin, Section 38:

Seems pretty simple, right?

If you charge for shipping on the sale of taxable tangible personal property, then that shipping charge is taxable. Unlike in some other states, it doesn’t matter whether or not you separately state the charge on the invoice. If the item you are shipping is not taxable, then shipping is not taxable.

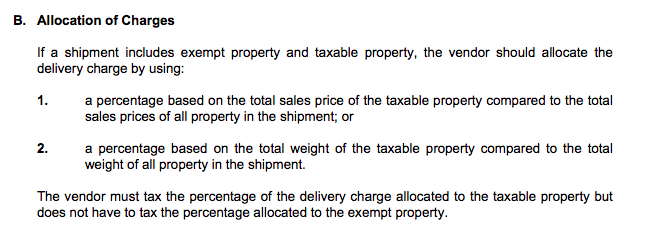

But in some cases you may deal with a situation where some items are taxable and some items are not taxable. What then? North Carolina’s bulletin addresses that, too:

In other words, you have a couple of options if some of your items are not taxable. Either divide the items by selling price or divide them by weight, and only charge sales tax based on the shipping amount you charged for the taxable items in the shipment.

Summary of Sales Tax on Shipping in North Carolina

If the item you’re shipping is taxable, charge sales tax on the shipping charges you charge to the customer.

If the item is not taxable, also don’t charge sales tax on the shipping charges.

If you ship a mix of taxable and non-taxable items, only charge sales tax on the percentage of items that are taxable. (Determine this either by using the weight of the taxable item or the price of the taxable item.)

Have questions about shipping taxability in other states? Check out our “Is Shipping Taxable?” state-by-state guide.

Ready to automate sales tax? To learn more about TaxJar and get started, visit TaxJar.com/how-it-works.