Is Shipping Taxable in New York?

by March 30, 2015

Sales tax can be a mystery for eCommerce sellers, especially because each state has their own set of guidelines for how they will apply it. When you get down to the nitpicky stuff, like whether you should charge sales tax on shipping, it becomes that much more confusing. In this article, we will look at how New York handles that particular question.

Is shipping taxable in New York?

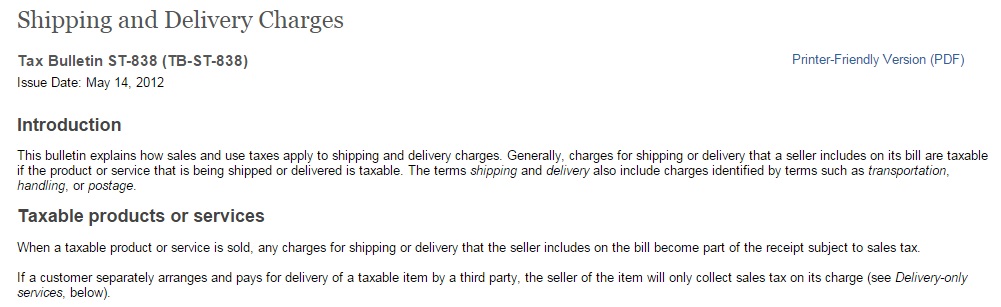

New York’s Department of Taxation and Finance has this to say:

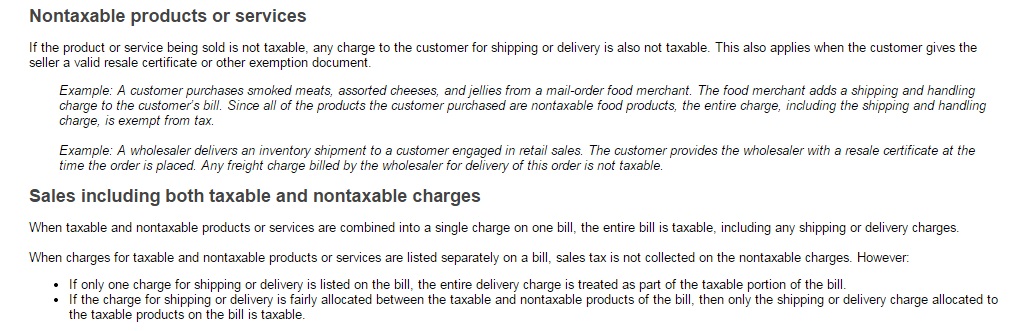

It looks like you will pay sales tax on shipping in New York. Thankfully, their Department of Taxation and Finance gives a lot of great examples to make it pretty simple. It boils down to this, if the items that you are shipping are taxable, then the shipping and handling charges are taxable.

If you have taxable and non-taxable items like a table and food items and there is only one charge for shipping and handling, then that charge is taxable. If there are two charges and the fee is fairly allocated between the shipping for the taxable table and the shipping for the non-taxable food, then the shipping charge for the non-taxable food is not taxable.

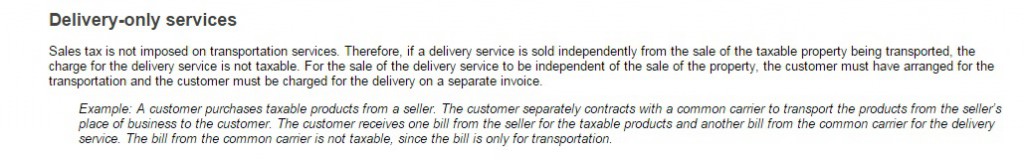

If your customer separately contracts for the delivery of the items that they ordered for you with a common carrier, then that is not taxable because it is only for transportation.

So in conclusion:

You will most likely charge sales tax on shipping and handling in New York.

If you are selling an item that is taxable and you ship it, the shipping and handling is taxable. The only way it ISN’T taxable is:

- You are shipping non-taxable items like grocery food.

- There are two separate charges for shipping, if you are shipping both taxable and non-taxable items. Each shipping fee must be balanced for the items shipped.

If a customer separately contracts for the delivery of the items ordered with a common carrier, then that bill is not taxable as it is only for transportation.

Other than that, you are going to have to pay sales tax on shipping and handling.

Still have questions about sales tax on shipping in New York? Start the conversation in the comments.

To learn more about TaxJar and get started, visit TaxJar.com/how-it-works.