Is Shipping in New Jersey Taxable?

by November 19, 2014

The more your business expands, the more you have to learn about sales tax. Each state has its own rules and regulations when it comes to this tax, particularly about whether shipping is taxable or not. It can be very confusing and frustrating to a business owner who just wants to sell items and make a living. One state that has confusing rules is New Jersey.

However, with a little clarification, the state’s rules on taxing shipping become much clearer. Let’s take a look.

Sales Tax on Shipping in New Jersey?

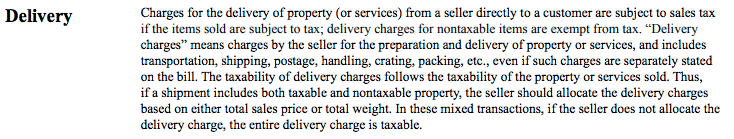

Here are the official rules on charging sales tax on shipping charges in New Jersey, straight from the New Jersey Division of Taxation:

Before October 1, 2005, any separately stated charge for shipping was not taxable, including if you had a “shipping and handling” charge. It was only when “handling” was a separate charge that you had to charge sales tax. Now, though, the rules are a little different. For one, most shipping transactions are taxable. Basically, if the goods delivered are taxable, the shipping is considered taxable as well.

So let’s say you have two items: one taxable, another not. What then? You base the delivery charge on either the total sales price or the total weight and collect sales tax on the portion that covers the taxable item. So if you have a taxable item that weights four pounds and another that weights two, you should only collect tax on the portion of shipping that covers the four pound item. If you don’t allocate the delivery charge, the entire thing is taxable.

Summary of Sales Tax on Shipping in New Jersey

It’s unfortunate that New Jersey changes its rules back in 2005 and made charging sales tax just a little more complicated for sellers in New Jersey. However, now that it’s implemented, with a little clarification it’s not overly complicated. Shipping costs you charge to deliver your products are taxable. However, they’re only taxable on items that are taxable. If you ship an item that isn’t taxable itself then you don’t have to collect tax on shipping that item. In the case of a taxable item/non-taxable item mix, you need only tax the portion of the shipping cost that’s applicable to the taxable goods. This is based on weight or the total cost of shipping. If you don’t separately state the cost of shipping the non-taxable item, then the entire delivery charge is taxable.

Have questions or comments about shipping in New Jersey? Leave a comment below and start the discussion!

Ready to automate sales tax? To learn more about TaxJar and get started, visit TaxJar.com/how-it-works.