Is Shipping in Georgia Taxable?

by September 23, 2014

Last updated July 14, 2017

One of the sticky points about collecting sales taxes in more than one state is determining if a state where you have sales tax nexus requires you to collect sales tax on shipping and/or handling charges.

Finding out information like this can be a nightmare as state websites seem like they’re purposely hiding everything. It’s not much of a treasure hunt!

Georgia is one such state that tends to hide everything on its website. Luckily for you we found everything you need to know about taxes when it comes to shipping. Here’s a run-through according to what is found on the Georgia Department of Revenue website.

Sales Tax on Shipping in Georgia

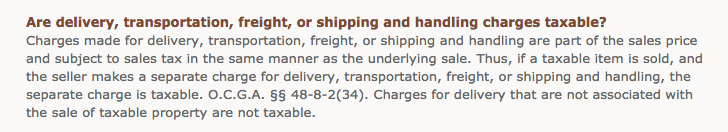

The rules for sales tax on shipping in Georgia are found in the “Rules of Department of Revenue Sales and Tax Division” paper under “Freight, Delivery, and Transportation.” Here’s what it says about basic shipping:

The state of Georgia considers charges for shipping, delivery, freight, etc. to be part of the sale price and thus taxable. This is even if you separately state the shipping charge on the invoice.

What if the Product You are Selling Isn’t Taxable?

If the product you are selling isn’t taxable, then shipping also isn’t taxable. But if you are sending a mixed shipment (some products are taxable and some are not) then you have two options:

- Charge sales tax on the entire amount of shipping fee collected

- Charge sales tax on just the percentage of the shipment that is taxable (you can determine this amount either by weight or by price

Summary of Shipping Taxability in Georgia

In most cases, shipping in Georgia is taxable, even if the shipping charge is separately broken out on the invoice. Check out our Georgia Sales Tax Guide for Business to find out more about sales tax in Georgia.

Ready to automate sales tax? To learn more about TaxJar and get started, visit TaxJar.com/how-it-works.